Everyone is talking about Bitcoin and cryptocurrencies as an investment, even though the real estate market has been hot for the past several years. Real estate has been accepted as a good investment for a long time, but Bitcoin is now gaining acceptance.

Is Bitcoin a Good Investment?

Bitcoin is the most popular of the different types of cryptocurrencies available today. Bitcoin, along with all other cryptocurrencies, is not tangible. You cannot hold them in your hand or put them in your wallet. And they do not produce income for you.

Bitcoin is a finite currency. Once all of the Bitcoin is mined, there will be no more. Unlike US dollars or other fiat currencies, a government cannot just print more. It is estimated that the final Bitcoin will be mined in the year 2140. Fiat currencies are prone to inflation because of this, while Bitcoin is not.

Bitcoin has risen dramatically in price during the past ten years when one Bitcoin cost $13 to buy. Today, Bitcoin is worth $45,620, and it would take quite an investment to buy just one Bitcoin. Buying Bitcoin is as easy as going to a cryptocurrency exchange online and buying it. It is a liquid investment that can be sold or traded easily.

Investing in Bitcoin is not for the risk-averse investor as it can fluctuate as much as 20% in one day. It is also prone to asset bubbles that have deflated quickly in the past. Bitcoin is not protected by a government agency like money in the bank is or the stocks held with your brokerage firm.

Is Real Estate a Good Investment?

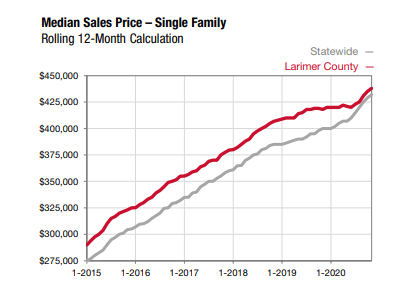

Investing in real estate is investing in something tangible, something you can see and touch. Real estate has been a hot investment during the past several years that even the pandemic couldn’t slow down. Home prices are up an average of 13.2% in July 2021 compared to a year ago. In some cities, prices have increased as much as 30% in the past year.

Real estate prices dropped dramatically during the 2009 recession. As soon as the recession was over, home prices made up all the losses and continued higher. Real estate is a good investment for several reasons, such as living in the home, renting the home, or remodeling and flipping the house for a profit.

Adding real estate to your stock portfolio is a good way to diversify your investments. Since real estate is a tangible investment, money can be taken from it in the form of equity and used as collateral for loans and other investments. Investing in real estate brings in continuous revenue in the form of rent.

Real estate does require maintenance, repairs, and upgrades. Buying real estate is not as simple as buying Bitcoin. For example, if you want to purchase real estate in Estes Park, Colorado, you would first have to look at homes for sale in Estes Park. And then go through the process of buying that home.

Bitcoin might have a place in a portfolio, but real estate is a more stable investment and easier to understand. Since real estate is a tangible asset, it is something unlikely to ever go to zero.